UI and SBA Loans – March 2020

THERE IS SO MUCH!!

Everyone, we are in this together – together, now is the time of supporting each other. While this post may go out beyond the borders of my community, I believe that as we navigate our way through this it will be our local communities that find a way through, with pooling of our collective knowledge and experience.

I am applying for the SBA loan to cover payroll, what do I do now?

| My employees have already been laid-off and filed for UI | My employees have reduced hours and have applied for UI | My employees are still working regular hours | |

| Unemployment | My employees have received UI Payments | My employees did not qualify and received no payment | N/A |

| Business decisions | If your employees have received any payment, pause***. | If your employees have not received payment from UI, you can bring them back to ‘normal’ hours and use the SBA loan for payroll | Your company can use the loan. AND Yeah I am glad you’re still working |

***If your employees have already received payment from UI, there is the potential to inadvertently put your employees in a pickle wit UI. If you choose to go back and pay from the date of lay-off AND they have gotten a payment from UI, they could owe the money back to UI. I would recommend that you pick at DATE in the future to bring them back to work, the SBA loans (HR748) are for 8 weeks of payroll. I would encourage a determination of which 8 weeks you’d like to utilize. Do you want to wait until you open and you’re able to go back to normal operations?

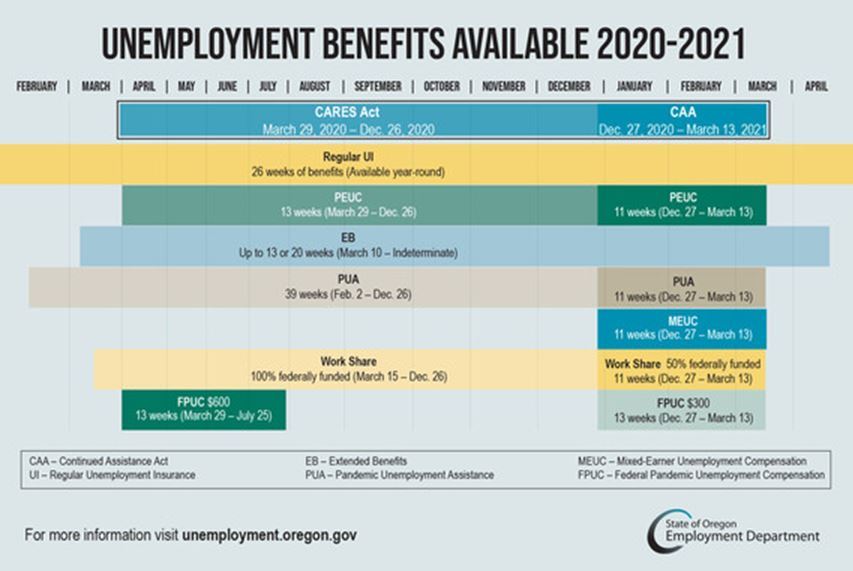

**Notes about UI HR748

Section 2102 (c) (1)(A) dates 1/27/20 to 12/31/20, weeks of UI Section 2101 (c) (2) 30 weeks.

Section 2104 (b)(1)(B) additional $600 a week – there is no clarity around who will qualify for this amount, from what I have gathered it is to help those who would have maxed out the normal weekly benefit and does not meet their “usual” or “normal” income.

If you’re interested here is the text for HR6201 and HR748 I will be referencing them, just in case you’ve run of things to do while home you can enjoy the 854 pages of HR748.

Here are a few other resources that have some value.

Oregon Unemployment Fund information Trust Fund by State Oregon ranks in the top for solvency. This matters because the State has the money to pay for claims, with little delay. Little fun fact Oregon was one of a few states who did not borrow from the fed during the downturn in the late ‘00.

The Chamber of Commerce notice about Loans can be found here.